Everyone has a credit history and credit score. If you have never borrowed before, your credit history will be empty. While your credit history and score are both important tools, your credit history may be more important as it lists all of your debts, both past and present, and the condition of your debts. The information contained in a credit history is used by potential lenders to determine if they want to lend more money to you, and at what interest rate.

Your credit history (also referred to as a credit report) contains a summary of how you have borrowed and repaid your debts. A credit report is an up-to-date, objective description of the status of your credit accounts, including but not limited to credit cards, loans, utilities, and rent.

Credit reports contain your personal information including name, social security number, birthday, employers and residences. Any variation of your name that you have used to apply for credit would be displayed in your report as well as any addresses you may have used.

The report lists all of your current and past credit accounts, payment activity, high balance, payment amounts, date of creation, type and status of each account. (Ex: open, closed, paid off, sent to collections, etc.) The accounts would include revolving credit (like a credit card), installment credit (a car loan or mortgage) and show if you are current on payment or past due by 30, 60 or 90 days. The account would display as open, closed, charged off, or in collections. The accounts should also list the name, telephone number and address of your creditors in the event you would need to dispute something on your report.

If you ignore the creditor’s request for payment, and you are unable to work out an agreement to repay or settle the debt, your bill will most likely be turned over to a collection agency. Your outstanding debt may also be sold to a debt buyer, and your delinquency is always reported to a credit bureau. This would be a negative mark on your credit report.

Credit reports may also list certain information of public record such as court judgments, tax liens, foreclosures or bankruptcies.

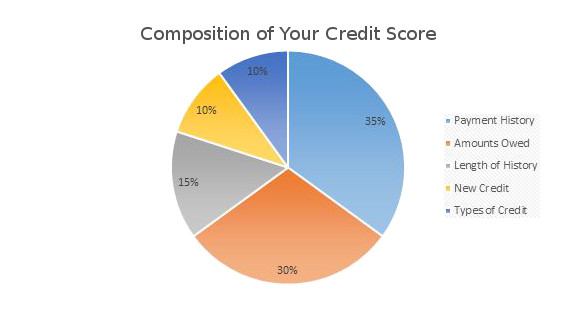

The information contained in your credit report is calculated into a credit score. While the credit score is important, it doesn’t provide as much detail as your history/report. The credit score provides a very quick snapshot of you as a borrower. Scores can range from 300-850 — the higher the score the better you look to potential lenders. Your credit score tells a potential lender how risky you would be to lend to. If you have a low credit score that can indicate that you are a risk to the lender. If the lender determines to lend to you at all, it may be at a higher interest rate. If you have a high credit score that indicates that you are not very risky to the lender and are responsible in paying your debts. You are more likely to be lent to and usually at a lower interest rate.